INSIGHTS & TIPS

Property Market

in Dubai & Best Sales

Property Market in Dubai and Best Sales

4th July 2021

The prices mentioned in the article are

current as of the date of publication

The prices mentioned in the article are current as of the date of publication

Introduction

Introduction

The Dubai real estate market gets more and more active with each passing month of 2021. The volume of sales transactions is steadily increasing, as many new investors both domestic and foreign, have regained interest in the Dubai property market. Particular improvement is noted for the high-end sector, including almost all types of real estate.

There is good news for would-be investors and end users as prices are following a negative trend generally, which allows buyers to make purchases at historically low costs.

Demand for completed homes is still high, which is confirmed by the dominating transactions for completed/second-hand properties compared with off-plan deals.

Despite the tendency to reduce supply, some of the major developers have launched many new projects which all sold out at an unexpected speed. These are the main highlights of the market by June 2021. Below we’ll provide a more detailed consideration for all the above mentioned features.

Sign Up Now

and Stay Informed

Join over 9500 members to get weekly updates on new off-plan launches in Dubai and latest news & tips

Zero spam. Unsubscribe at any time

Sign Up and Stay Informed

Join over 9500 members to get weekly updates

on new off-plan launches and latest news & tips

Zero spam. Unsubscribe at any time

Real Estate Market

Performance

Real Estate Market Performance

As stated in the Dubai Land Department bulletin dated May, 2021, the beginning of the year (January – April 2021) outperformed during the same period compared to the previous year by 51%. In nominal terms, the entire sector resulted in 25,455 transactions estimated at an impressive AED 92 billion (USD 25,05 billion) of capital.

Within the first four months of the year the share of new customers entering the market grew by 65% and totaled 8,749. An increase on a yearly basis amounted to 54%. Basically, the buyers in the market are domestic ones, UAE-nationals and residents have acquired housing as their primary home and taken advantage of the relatively low property prices to get a step up on the property ladder (ValuStrat data). As per the representative of CORE Research & Advisory, around 81% of total transactions were made through mortgage financing within the first half of 2021.

While domestic end-users obtain properties within the medium price bracket, the prime residential market witnesses an inflow of foreign buyers, who can easily afford their 3rd or 4th home for millions of dirhams. They mainly reside in large villas and or penthouses. From January 2021 until the beginning of May, 81 villas were sold in Palm Jumeirah alone.

For the aforementioned period total investments in properties had reached AED 36 billion (USD 9.8 billion), displaying an increase of 44% in comparison with the same period in 2020. A healthy rate of growth since January 2021 is an encouraging sign and an additional reason for strengthening investors’ trust within the region.

The uptrend successfully continued in May, booming with 4,429 deals worth AED 11.11 billion (USD 3 billion). Essentially, this will be the next record-breaking month, which has displayed the best results year on year since 2017. A monthly increase in overall sales value is estimated at 1.4%.

Residential Sales

Residential Sales

In May 2021 77% of all sales transactions were for apartments, while 23% were for villas. The majority of residential sales were completed in the secondary market (62%) and 38% were sold from off-plan deals. To a large extent the results of May were a repeat of the market performance in April: 60% - secondary properties, 40% - from the developer.

As stated before, since the start of the coronavirus pandemic the prices for residential properties have been generally declining across the emirate, particularly for apartments. Growth is suppressed by a combination of factors, including an imbalance between supply and demand, where new affordable housing has prevailed. Still, due to growing interest in certain types of housing, namely ready-to-occupy units, asking prices in some communities have moved upwards to at least single digits by June 2021.

Prices Rising

According to the Property Monitor data, the most notable increase in property asking prices in May 2021 was registered in villa communities. The upward change varied between 0.86% and 5.65%:

- Palm Jumeirah Fronds – Garden Homes, changed by 5,65%. Average price per sq. ft AED 2,118 (USD 577).

- Jumeirah Islands, changed by 5.47%. Average price per sq. ft AED 1,102 (USD 300).

- Jumeirah Golf Estates, changed by 4.89%. Average price per sq. ft AED 994.33 (USD 270.70).

Pricing for apartments in some of neighbourhoods across Dubai grew at a more moderate rate and only increased to a maximum of 3.86%.

- Jumeirah Lake Towers, changed by 3.86%. Average price per sq. ft AED 790 (USD 215).

- Dubai Marina, changed by 3.76%. Average price per sq. ft AED 1,150 (USD 313).

- Downtown Dubai, changed by 2.74%. Average price per sq. ft AED 1,349 (USD 367).

Prices Falling

In places where villas and townhouses are located, there were not so many registered declines compared to the apartment sector. Pricing for the Arabian Ranches 2 homes decreased by 2.27% and resulted in AED 903 (USD 246) for the average cost per sq. ft. Dubai Investment Park and Dubai South Townhouses saw an insignificant decline of 0.4%.

Apartments in a series of communities became a bit more affordable as of May 2021. Price deviation ranged from 0.06% to 4.93%. To give an example, residences in Dubai South were cheaper by 4.93% and averaged at AED 608 (USD 166) per sq. ft. Prices for Discovery Gardens units fell by 2.41% and in Business Bay decreased to 1,17%.

For investors to note: As we have clearly seen from the charts above, the numbers can vary within one city and within one month. Despite the general trend, all areas experience different price movements. Since property price is defined by location, an investor should focus on the reality of the market in a definite local area. Rising prices nation-wide won’t help, if one particular district is in decline. On the contrary, there is no point in becoming discouraged by the overall price decrease, because some localities will still continue to rise.

Residential Rentals

Rentals for villas rose by 4.7%, while apartment rents fell by 10.3% in the period to April 2021. This market is especially sensitive to migration, job losses and huge departures of thousands of workers have inevitably affected the prices for leasehold. Rents are suppressed generally, although there is a moderate increase in certain neighbourhoods. Landlords have to cater to the needs of tenants, so at the moment it would be detrimental to increase the price of rentals, instead it would be much more beneficial to offer incentives including payment by 12 cheques (in contrast to yearly or quarterly installments) or receive payments via credit card etc. As per the Executives of Asteco, this trend will continue throughout the coming year.

Rents Falling

The most significant declines in rental rates during the period from January to May 2021 were registered in Al Jaddaf, Bluewaters Island, Trade Centre, The Greens, Barsha Heights and Jumeirah Lake Towers (JLT), according to the research group CBRE Middle East. In May 2021 a maximum decrease of the average villa rental was seen in Falconcity of Wonders with a 6.9% downturn. Insignificant declines by about 1% took place in Dubai Silicon Oasis and Dubai South Townhouses.

In summary, apartment leaseholds have become more affordable compared to detached housing (villas and townhouses) since the beginning of the year. Quite a number of apartment communities across Dubai witnessed rental prices fall from 0.2% - 5.84% in May 2021. Homes to rent in Al Khail Heights were offered 5.84% less than in April, followed by Dubai Festival City with a 5.02% decrease and Discovery Gardens 3.04% less. Other areas, like International City, Al Habtoor City, Dubai Studio City and Motor City experienced an insignificant decline in rental prices.

Rents Grow

Rental costs grew in almost every villa community across Dubai from January through to May 2021. The highest growth was registered in Hills Estate and Wasl Gate. Due to the strong demand for spacious villas in waterfront and well-established communities, in areas such as Palm Jumeirah, Emirates Hills, The Springs, The Meadows and Arabian Ranches which all experienced a sustained increase.

In May the most notable improvement in rents amounted to 6.2% for the Victory Heights villas, followed by Emirates Living – by 3.77%, Jumeirah Golf Estates – 3.04% and Mohammed bin Rashid City Townhouses – 2.86%.

New Launches from The Developers

Despite the complicated economic conditions and an uptrend for new housing supply reduction, some of the leading national developers still launched new residential projects, which turned out to be extremely successful amongst buyers. In the first five months of 2021 Emaar sold properties for AED 10.5 billion (USD 2,86 billion) with a 250% increase compared to the same period in 2020.

May 2021 was particularly rich in newly launched releases, just to name a few:

- Murooj Al Furjan villa community by Nakheel.

- Palm Hills Estate – the villas project in collaboration with Elie Saab and Emaar.

- Green Woods at DAMAC Hills – townhouses by DAMAC Properties.

- Urban Oasis by Missoni, represented by Dar Al Arkan.

- Waves at Sobha Hartland – a 592 apartment building by Sobha Realty.

Industry executives mention that recent sales transactions of both medium off-plan and high-end completed homes were finalized at record speed – within days.

Property Flipping

The Best Sales

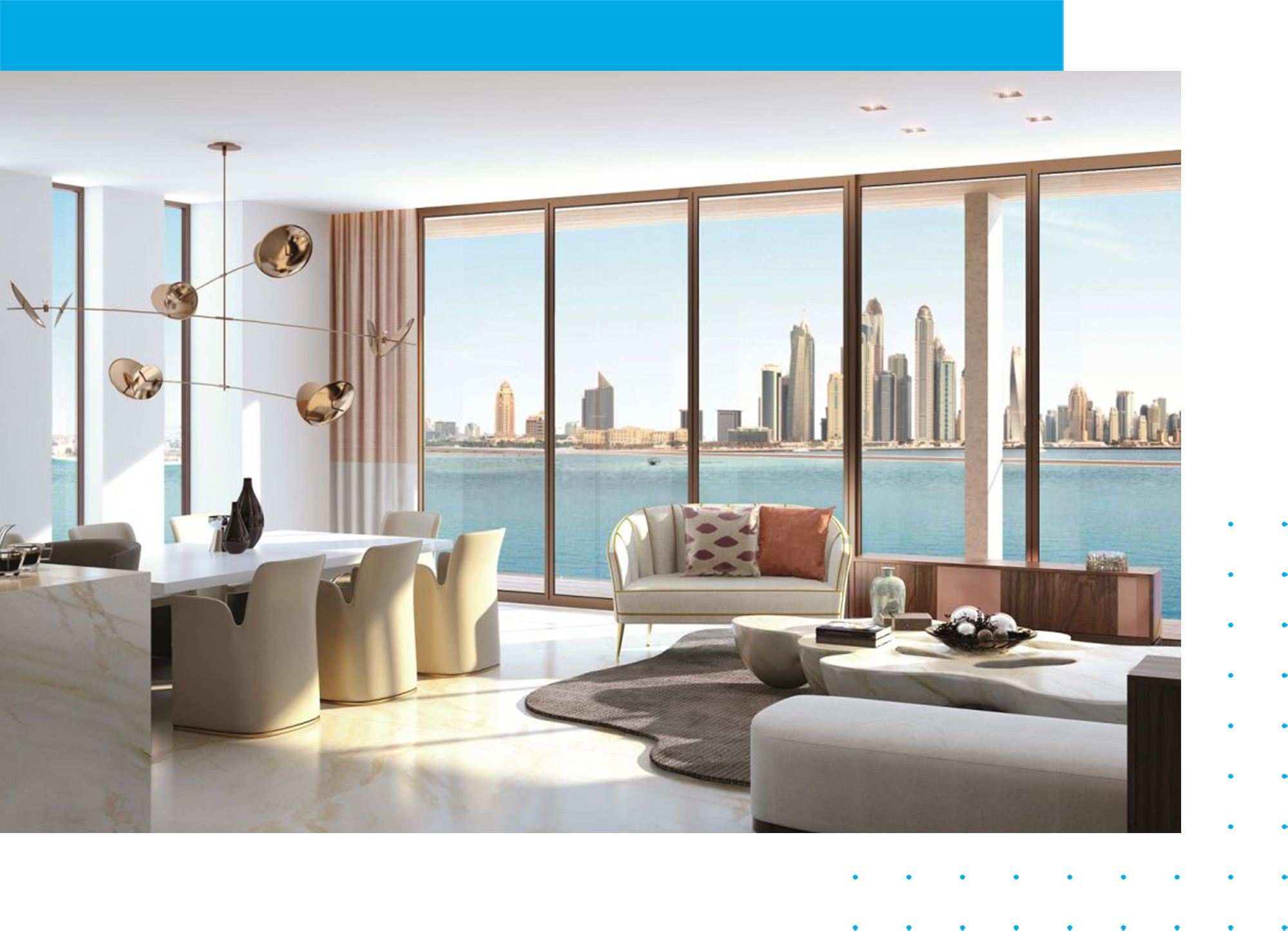

Dubai is always about luxury, fast cars and top-dollar properties. The latter are consistently in high demand among high-profile customers from all over the world. Even with state borders closed and international flights interrupted, Dubai’s prime residential market is booming with high-price sales.

From January until May this year, the most noticeable upmarket sales transactions include:

- One 100 Palm – AED 111.25 million (USD 303 million).

- Emirates Hills villa (Sector R) – AED 68 million (USD 18.5 million).

- Palm Jumeirah villa – AED 55 million (USD 15 million).

- Dubai Hills Grove – AED 49.8 million (USD 13.6 million).

- Villa in Jumeirah 2 – AED 45.17 million (USD 12.3 million).

- Palm Jumeirah, Frond M – AED 45 million (USD 12.3 million).

- Palme Couture Residences – AED 43.5 million (USD 11.84).

- Jumeira Bay Island, BULGARI Resort – AED 43.5 million (USD 11.84).

- Omniyat One Palm – AED 43 million (USD 11.7).

- Palm Jumeirah, Frond M – AED 42 million (USD 11.43).

The Latest Property

Market Updates

for June 2021

The Latest Property Market Updates, June 2021

The first week of June gave an impressive start, with 2,069 transactions worth AED 10.7 billion (USD 2.91 billion) of gross value. According to the Dubai Land Department’s weekly report, these amounted to 219 lots sold for AED 1.46 billion (USD 400 million) and 1,418 apartments and villas totalling AED 2.81 billion (USD 770 million).

The high sales of plots for construction were topped by the total transaction of AED 300 million (USD 81.7 million) in value, which took place in Palm Jumeirah. The most expensive villa worth AED 341 million (USD 92.84million) was purchased in Dubai Investment Park and the most significant apartment sale was registered in Marsa Dubai, valued at AED 284 million (USD 77.32 million).

The largest number of deals totalling 101 were made in Al Hebiah (4), followed by Hadaeq Sheikh Mohammed Bin Rashid (18) and Al Hebiah 3 (15).

The Bottom Line

The Bottom Line

- Dubai’s real estate market goes well with the new normal and proves its robustness and attractiveness to both local and international investors. Entire sectors resulted in 25,455 transactions estimated at an impressive AED 92 billion (USD 25.05 billion) of capital, demonstrating an increase of 51% in the number of transactions and 72% in value year on year.

- Stable month-on-month increase allows us to suggest an established positive trend towards recovery of the industry, largely affected by the coronavirus pandemic in 2020. April and May 2021 have had the highest values in sales since 2017.

- The right strategy for investors during overall negative price movement is to remember that in some areas there is a decline, in some a rise. Accounting for a local market in a particular area should come first.

- May 2021 was booming with new launches from industry leaders, such as Emaar, Nakheel, DAMAC and Sobha Group. The start of sales were all successful.

- The prime housing market is on the upturn: from January until the beginning of May, 81 villas were sold in Palm Jumeirah alone.

- A Promising beginning for June 2021 with 2,069 transactions worth AED 10.7 billion (USD 2.91 billion) of gross value.

Did You Like

The Article?

Subscribe & be kept up to date on what's happening in the world of Dubai property

Zero spam. Unsubscribe at any time

Did You Like The Article? ![]()

Subscribe and be kept up to date on what

is happening in the world of Dubai property

Zero spam. Unsubscribe at any time

Damac Lagoons

VIDEO OVERVIEW

Madinat Jumeirah Living

VIDEO OVERVIEW

You won’t need to look through countless listings on other the UAE's property websites.

We have gathered all available information about off-plan property in one place and created a short quiz for you to find your perfect home in less than 2 minutes

Got Confused? Complete A Quiz & Get The Best Offers

Being qualified property experts with years of experience, we realize how confusing Dubai’s off-plan property market could be for new buyers, as well as for professional investors. Especially when there are thousands of off-plan properties in Dubai.

You won’t need to look through countless listings on other the UAE's property websites. We have gathered all available information about off-plan property in one place and created a short quiz for you to find your perfect home in less than two minutes.

Follow simple steps on the screen to get your personal selection of projects that meet all your requirements. Explore any project in Dubai relevant to you and contact us!

It takes less than 2 minutes

Notify Me About New Projects

Be the first to hear about new off-plan projects and get

access to VIP pre-launch bookings with special offers

Zero spam. Unsubscribe at any time

© 2025 Metropolitan Premium Properties