INSIGHTS & TIPS

Dubai Real Estate

Investing Guide

Dubai Real Estate Investing Guide

4th May 2021

Introduction

Introduction

Probably, the first thing that comes in mind in place of investment when you have money on hand is real estate. There may be alternatives, of course, but equity backed by brick and mortar definitely wins on many points. The choice is enormous here and many people are lured by properties outside home country, especially resort-style with much sun and the sea.

Within many years Dubai was perceived as one of the most popular directions. How to step up the foreign market, where to get started and how does it work in Dubai on the whole – not everybody knows and here we try to highlight the basic ways of real estate investing.

Dubai globally famed for its 7-star hotels, booming tourism and evolving business was always taken as a highly attractive investment field. But the coronavirus pandemic has recalibrated the traditional landscape and those who planned to buy property, as well as mature investors, wonder now whether Dubai real estate market is still worthy of placement of funds.

The power balance has really been changed and the 2020 outlook has stated an increased demand for secondary homes, detached villas and townhouses, that offer more privacy and space. Along with that, in contrast to mainstream market deals prime transaction volumes experienced 7.9% growth compared to 2019. The most popular districts to buy luxury properties appeared to be Downtown Dubai, Palm Jumeirah, Emirates Hills and District One. Life keeps running though the trends are different now.

Apart from residential properties there are other categories of real estate: commercial, industrial, raw land and special use – property used by the public as, schools, parks, places of worship. Each sector has its own investment horizon and Dubai actually offers a comparatively easy way of tapping any of these markets for foreigners.

Sign Up Now

and Stay Informed

Join over 9500 members to get weekly updates on new off-plan launches in Dubai and latest news & tips

Zero spam. Unsubscribe at any time

Sign Up and Stay Informed

Join over 9500 members to get weekly updates

on new off-plan launches and latest news & tips

Zero spam. Unsubscribe at any time

Investment Goals

Investment Goals

What to look for when investing to real estate in Dubai? The first and foremost thing about that is to identify the investment purpose. The main directions look as follows:

- Buy and self-use. People buy homes for self-utilization and get value appreciation;

- Buy-and-lease. The property acquired is intended to be rented out and generate return on investment;

- Buy and sell in short terms. Real estate is bought and disposed of after three or four months (often in rising markets or after renovation made);

- Buy and sell in long terms. This option implies the property appreciates in the long run, after years.

The main thing that can make property price increase is location. If the place is modified to the best and becomes more popular then the real estate does tend to appreciate it. Location defines its intrinsic value as well. Public transport, shopping opportunities, quality of schools, parks and municipal services can drive the prices up and down. So, the first piece of advice for the first-timers is to think of location first.

Another important moment lies in doing mathematics: calculations of expected costs aside from market price (property transfer fee by 2% from buyer and seller, insurance, other registration fees, yearly service charges plus mortgage, if any) and profit opportunities (rental returns or planned dividend after resale). Sure, adjustment of future costs is more feasible than appraising potential dividends, thorough weighing will at least give you a clear picture whether your income is correlated with scheduled expenditures.

How to Invest

in Dubai Real Estate

How to Invest in Real Estate

Technically there are two major ways: direct and indirect. Some of the most common ways to invest directly include homeownership, rental properties and flipping houses.

Homeownership

Non-residents are permitted to buy properties in designated areas across Dubai, so called free investment zones. These areas hold a lot of off-plan properties offered with competitive payment plans and buying homes under construction looks one of the most affordable and easiest ways to tap the market. The scheme works as follows: the property is acquired for self-use and gets value appreciation within years.

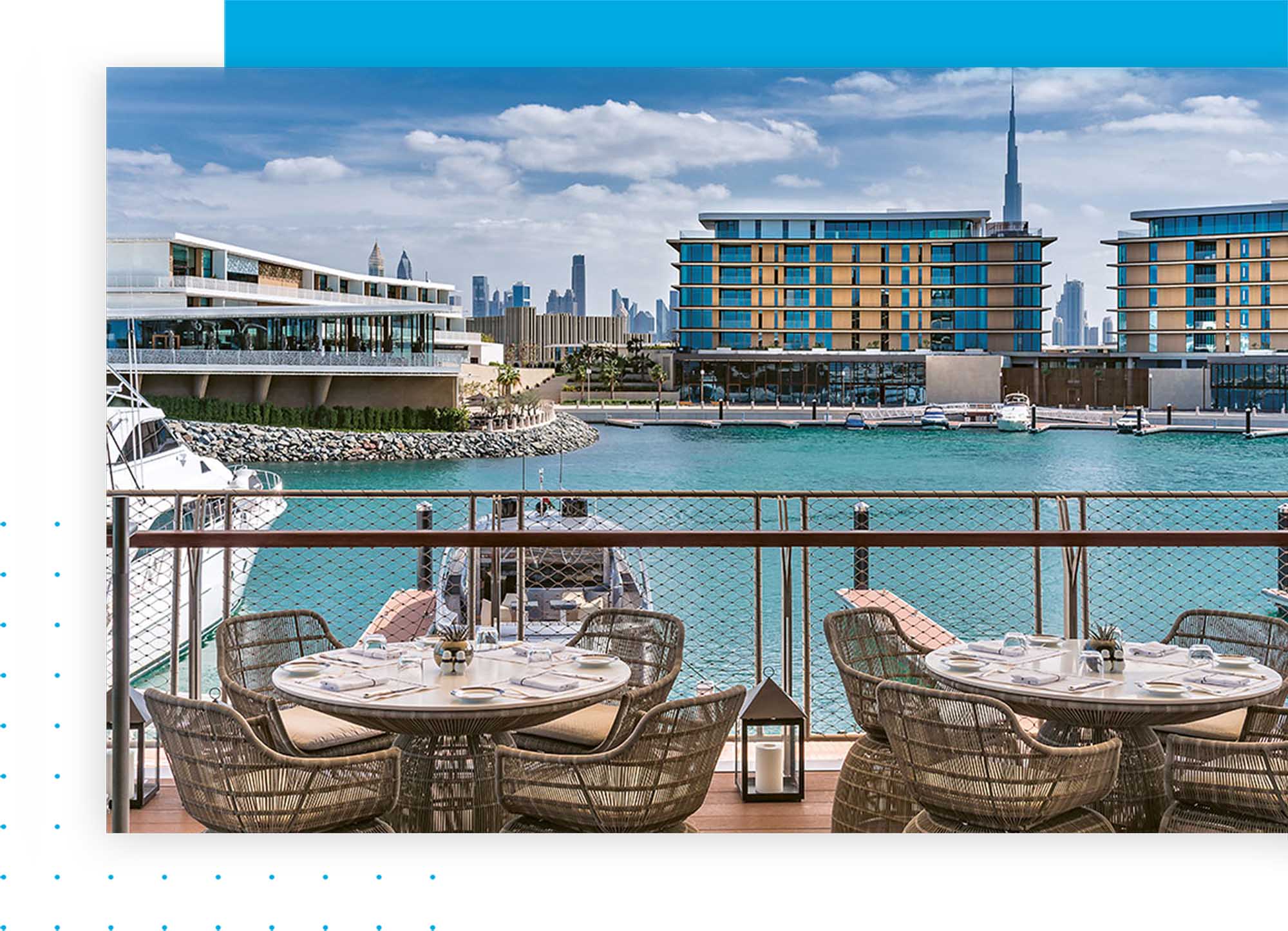

In Dubai foreigners often acquire housing to stay in for vacations, or because they run business over there. Some families buy property in Dubai as the second or the third home. Apartments is the top choice for the majority of end-users after villas and townhouses. Speaking about luxury real estate, we mention trophy properties, like waterfront or golf standalone villas, beach residences on private islands or full-floor penthouses at high-rise towers. That’s a sound investment for foreigners, because Dubai is a high-profile resort destination and has much to offer apart from elite homes only.

It is possible to get property financing via mortgage. Non-residents may apply for 70-75% of purchase price loan. Here is one thing, that first-time buyers should be careful about: banks may approve even greater amount than one requests for. The applicant should keep in mind that expensive premises involve awesome money for insurance, maintenance and service charges. For instance, apartments in Dubai Marina were charged at a rate AED 13.86 per sq. ft in 2020, while in Downtown Dubai the service fee rose up to AED 65-67.88 per sq. ft. Consequently, it would be wise to give up the idea of buying luxury property if there is no possibility to cover all related expenses in the long run and live on an accustomed scale. It’s better to obtain property on a budget, then amass money, dispose it off and buy more luxurious home.

Tip: Before you invest, take care of features that will add value to your home and make it look different to cookie-cutter apartments and ensure the best return on your investment.

Rental Properties

Many people tend to secure themselves by “passive income” being a landlord. Dubai real estate market is suitable for that: first, the demand for property lease is enormous, as around 95% of people living in Dubai are non-natives who come for work & they have to rent homes and second, residential properties yield between 5-12%. That’s a sound ROI compared to EU capitals, or Hong Kong where 2.5% of rental return considers normal.

Basic outlines of property lease in Dubai include:

- The interactions between landlords and tenants are regulated by the Law 26 of 2007 principally;

- All lease agreements, newly made, being added with any closures and after termination, are subject to registration in Ejari system;

- Tenancy contracts are signed for one year and then may be renewed;

- Rental is calculated and paid annually by post-dated cheques, in practice may be paid quarterly;

- Popular options include long-term and short-term leases, both providing own benefits.

Tip: Before investing in rental estimate the area’s economic outlook, consider the year-round and peak-season traffic.

When investing in rental properties, one should be prepared become a landlord – a person who not only collects money, but does a lot of work in place of finding the tenants, legalizing the tenancy agreement and providing maintenance, repair and restoration of any faults and defects occurred during utilization. Actually, that’s a full-time job and not everybody can bear that in the long run, but fortunately any owner may hire rental property management. Professional team will settle all the routine with leaking faucets or busted locks and the owner will enjoy the end result.

The investors make money by collecting rent and through appreciation. If the property appreciates in value the owner may sell it at a profit when the right time comes or borrow it against the equity to make another new investment. Best areas for investment in Dubai described here.

Property Flipping

Property Flipping

Flipping houses means the scheme where the property is acquired and quickly resold to other buyer at a profit. Quickly means no longer than within a year, as a rule. This method of making money implies getting margin on resell of undervalued properties, which are those under construction, the ones located in developing areas or units that require upgrade. The scheme works in two ways:

1. Repair and update. An investor buys the property, which they believe will add value after refurbishment being made. Then the investor makes alterations and sells it at a price that exceeds total investments (purchase price, renovation costs, etc.).

2. Hold and resell. This approach works well in rising markets and with off-plan properties. Flippers acquire real estate, wait for some time and then dispose it of at a price covering initial deposit, associated expenditures and the margin itself.

Tip: It would be ideal to complete all necessary improvements to the property within as short timeframe as possible and then sell it at a profit, otherwise there’s a risk to bear mortgage burden for too long and lose a chance to gain a profit after resell.

Flipping is a very welcome field for property speculations in terms of off-plan deals due to low barrier to entry. For instance, initial installment in many payment plans requires 5% of the purchase price only. In this light, the UAE government took the package of measures preventing real estate market from overheating – prices inflating to unrealistic values, that happened in mid 2000s in the UAE.

Firstly, Dubai Land Department mandates all the off-plan sales to be listed in the interim property register. Secondly, payments for off-plan transactions must be kept on the escrow accounts. Mortgages may be hand out by the UAE licensed banks only. What’s more, developers have no right to sell and advertise property until they register and approve the development project by the Real Estate Regulatory Agency, what includes bank guarantees for 20% of the project value, approval of the development contract, payment plans, construction timeframes, confirmation of land plot ownership and more.

Other restrictions relate to borrowings to finance complete and off-plan property purchase: LTV ratio for the UAE-nationals reaches 80% as a maximum for a completed property (if it is priced at AED 5 mln and less); LTV ratio for non-residents amounts to 75% for a completed first property (valued AED 5 mln and less). Furthermore, banks are induced to conduct careful investigation of borrowers’ underwriting and must take into account a number of details, as existing debts, yearly income, etc., and limit mortgage period and loan amount due to age, paying capacity of the customer.

Indirect Investment

Indirect Investment

Indirect investments are made when entering specialized real estate investment groups, trusts (REITs), mutual funds or real estate limited partnerships (RELPs). These are the clubs, where participants pool their money to invest in real estate and share profit afterwards. Actually, more versions of suchlike foundations exist, helping as micro-investors and large-scale players to build wealth.

Real Estate Limited Partnerships (RELPs) is a form of cooperation between general partner, which can be developer or property management company, and outside investors, who are limited partners. The partnership is organized to buy project under construction (or to build one), then to sell the units and distribute the profit. The purchase is financed by the investors’ money and upon disposal they get a sizable yield, calculated on a per share basis. After final payoff the group is liquidated.

Real Estate Investment Trusts (REITs). Generally speaking, these are dividend paying stocks, appropriate for investors who look for regular income, less responsibility and work (except making scheduled installments). The stocks use stakeholders’ money to buy, operate and resell income-producing properties. These are mainly malls, office buildings, hospitals. To qualify as a REIT the entity must deliver 90% of its taxable profit to its shareholders in the form of dividends. Non-managing investors or limited partners have no control but share cashflow and profits based on their investment.

Currently there are two REITs listed in Real Estate Investment Trust – Nasdaq Dubai: Emirates REIT and ENBD REIT (both are Sharia compliant).

Emirates REIT was found in 2010 and has 11 properties under its management. Portfolio market value is estimated around USD 855 mln. Emirates REIT operates in a variety of properties, though focusing on commercial and educational ones.

ENBD REIT holds diversified assets, like offices, residential and alternative classes. Since 2005 it has been providing investors with stable and regular income by means of annual dividends and long-term capital appreciation in net asset value per share.

Real Estate Mutual Funds offer greater selection of assets to their investors than REITs do. Another advantage is relatively small amount required to enter a fund, if compared to buying an individual REIT. Typically, mutual funds supply retail investors with all necessary data, as analytics, research and forecasts. They select and display the range of properties, explaining why this or that property worthy to invest.

Real Estate Investment Groups operate with rental properties. The group buys or builds a building or a set of them (hotel, offices) and allow investors to buy out one or more units thus joining the group. The group management holds all responsibilities of marketing, finding tenants and maintenance. An investor should pay certain percentage of the rental they gains for that service in exchange. Making money in hospitality assets is relatively easy and profitable in Dubai – it is №1 in the world in terms of tourist business turnover and has multiple hotel projects on offer.

In Dubai property funds may be established under jurisdiction of Dubai International Financial Center and they are regulated by respective authority Dubai Financial Services Authority (DFSA). DFSA funds offers protection to retail investors and ensures regulation of the fund management service providers, including fund administrators, custodian and trustees. DFSA provides jurisdiction for setting up a property fund platform.

For instance, the DFSA registered digital platform allows to earn rental income when investing only AED 5000 in one property. Other online crowdfunding platforms offer to place personal funds amounting to AED 10 000 and diversify one’s portfolio from one to several properties.

Why Invest in

Dubai Real Estate?

Why Invest in Real Estate?

Real estate as an asset class offers competitive risk-adjusted returns and diversifies an investor’s portfolio. Thanks to its low volatility, this sector looks safer than equities and bonds. Real estate has little or negative correlation to other assets, that means when the stocks are down, property market is up. Besides, real estate is a protected investment, because it is less affected by principal-agent conflict, and due to its tangible nature, it depends less on the integrity and competence of managers and debtors.

The Power of Leverage

The Power of Leverage

Real estate is backed by a very helpful tool, that can’t be implemented in other asset classes – mortgage. When investors buy stocks, they have to pay an entire amount to the fullest at the time they place a purchase order. Even in case of buying on margin, the borrowed amount is less than with real estate.

Most conventional mortgage in the UAE banks requires 15% down payment for GCC-residents and 20-25% for non-residents. Mortgage registration fee is calculated at a rate 0.25% of the loan amount.

The magical nature of this kind of leverage is that paying only a fraction of the real property value a purchaser becomes an owner from the moment the papers are signed. Adding to that, landlords may take the second mortgage against equity of their homes and that will help to buy additional properties.

Property Market

Perspectives in Dubai

The Bottom Line

- Real estate is a sound investment, as it offers lower risks, better yields, and greater diversification than the stock market.

- Dubai real estate market opens welcome sources of income for foreign investors through renting property out. Not every country offers easy purchasing process for foreigners and tax-free environment coupled by 5-12% of rental returns.

- Foreigners as well as natives may invest in real estate in direct or indirect ways. Direct investment implies homeownership, rentals and flipping; indirect methods refer to joining real estate investment trusts, fund partnerships.

- One of the most common ways of making money in real estate by collecting rent is to become a landlord. Another popular option is to profit through property appreciation.

- Property flipping (resell at a profit within a short period of time) works well in rising markets and off-plan properties.

- Managing real estate properties for the long term is not for everyone. Alternatives appear when participating in REITs or more affordable REIGs, where the investors put the money in one or more projects and benefit from risk-adjusted returns and little work.

- Crowdfunding and digital investments platforms suite micro-investors offering relatively low thresholds. One may need to pay AED 5000 (around USD 1400) to start investing in an attractive project and earn income.

- Aspiring real estate owners can buy a property using leverage, paying a portion of its total cost upfront, then paying off the balance over time.

Did You Like

The Article?

Subscribe & be kept up to date on what's happening in the world of Dubai property

Zero spam. Unsubscribe at any time

Did You Like The Article? ![]()

Subscribe and be kept up to date on what

is happening in the world of Dubai property

Zero spam. Unsubscribe at any time

Damac Lagoons

VIDEO OVERVIEW

Madinat Jumeirah Living

VIDEO OVERVIEW

You won’t need to look through countless listings on other the UAE's property websites.

We have gathered all available information about off-plan property in one place and created a short quiz for you to find your perfect home in less than 2 minutes

Got Confused? Complete A Quiz & Get The Best Offers

Being qualified property experts with years of experience, we realize how confusing Dubai’s off-plan property market could be for new buyers, as well as for professional investors. Especially when there are thousands of off-plan properties in Dubai.

You won’t need to look through countless listings on other the UAE's property websites. We have gathered all available information about off-plan property in one place and created a short quiz for you to find your perfect home in less than two minutes.

Follow simple steps on the screen to get your personal selection of projects that meet all your requirements. Explore any project in Dubai relevant to you and contact us!

It takes less than 2 minutes

Notify Me About New Projects

Be the first to hear about new off-plan projects and get

access to VIP pre-launch bookings with special offers

Zero spam. Unsubscribe at any time

© 2025 Metropolitan Premium Properties